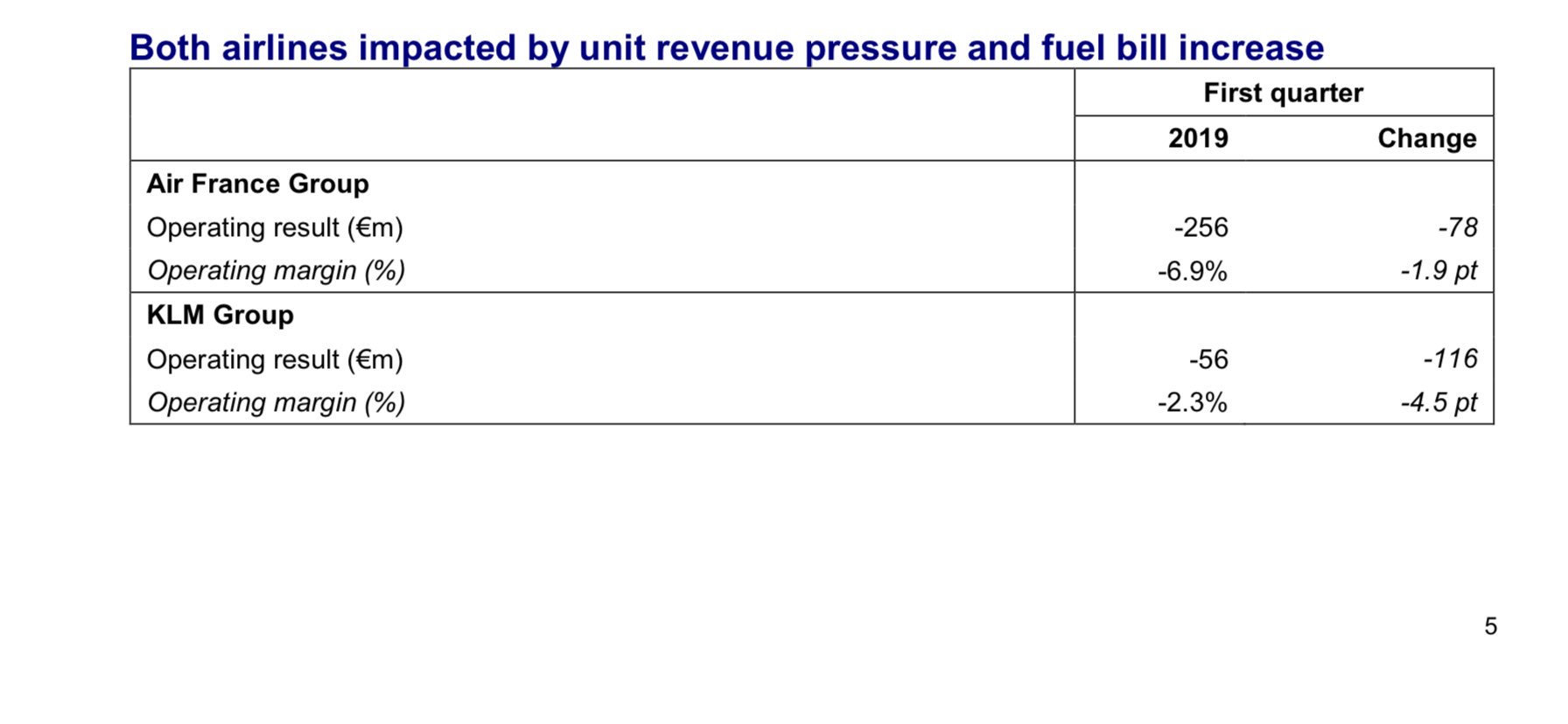

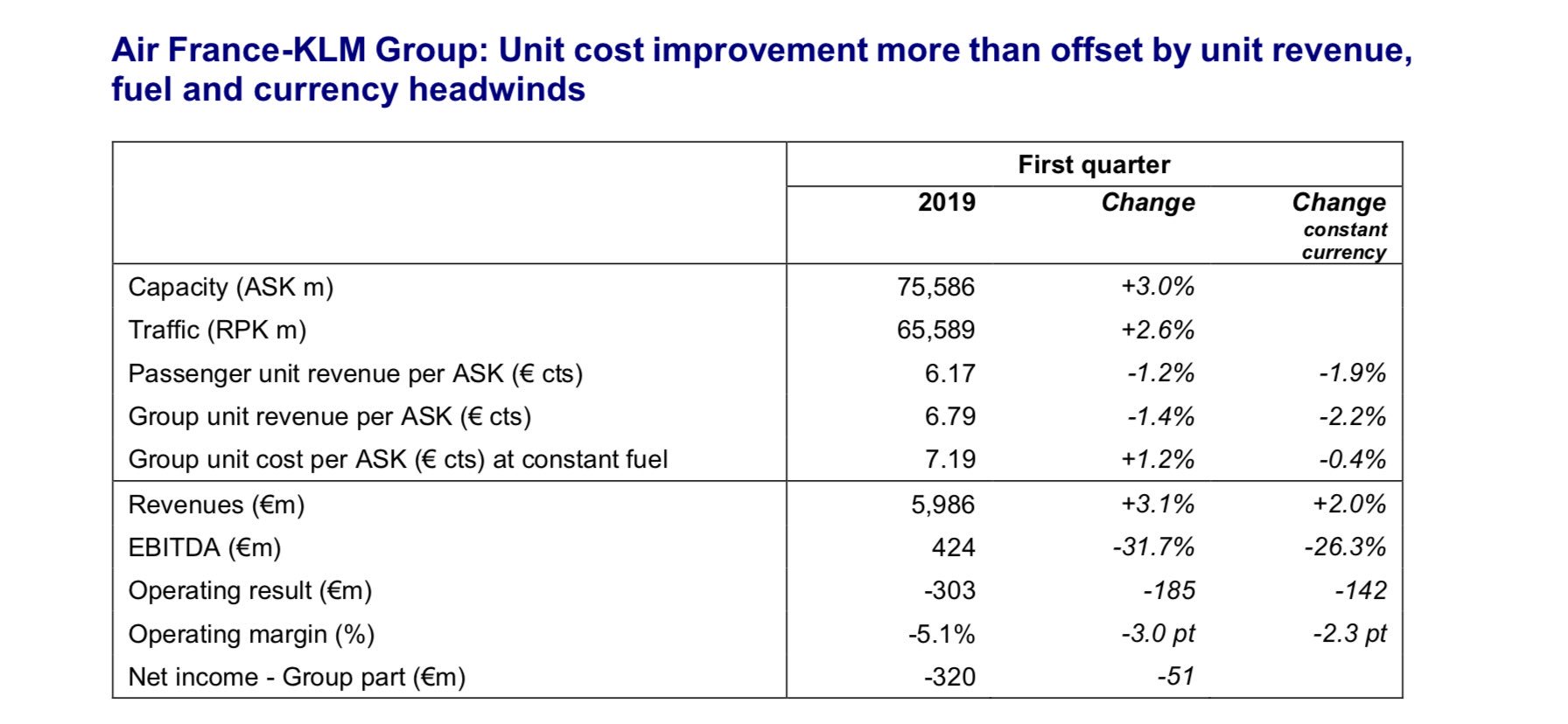

The Air France KLM Group just published the financial results for the first quarter of 2019. Despite higher capacity (+3%), traffic (+2.6%) and revenue (+3.1% to €5.986 billion), the operating result of the group significantly dropped resulting in a net result of €-303 million (compared to €-118 million in the first quarter of 2018). Net results for Air France (€-256 million), KLM (€-56 million) and Transavia (€-71 million).

Benjamin Smith, Air France-KLM Group CEO said: “As anticipated, the first quarter has been challenging for the European airline industry including the Air France-KLM Group, as substantial industry capacity growth in the off-peak business period led to unit revenue pressure. In this context, the Group achieved further improvement in unit cost while reaping the benefits of its efforts to strengthen its positioning, as evidenced by the first signs of progress in operational performance at Air France, notably in term of “Net Promoter Score” and punctuality. These elements, together with a more benign industry

supply outlook for the summer, lead us to expect improving trends in the rest of the year and to confirm our full-year guidance. We aim to have a capital market day planned in November 2019 to further outline the Group strategic directions.”

OUTLOOK 2019

- Long Haul industry capacity to / from Europe for the summer 2019 is projected to grow at a slower pace compared to last year, particularly to Middle East, North America and Asia.

- Based on current data for Passenger network:

- Long-haul forward booking load factors from May to September are on average ahead

compared to last year. - Network passenger unit revenues at constant currency expected to slightly improve

compared to last year for the second quarter 2019, with positive long haul unit revenues largely offset by negative point-to-point unit revenues.

- Long-haul forward booking load factors from May to September are on average ahead

- Full year guidance confirmed:

– Unit cost (CASK) reduction between -1% and 0% at constant currency and fuel price,

– Net debt/EBITDA ratio below 1.5x.

Read the full press release (PDF).

Lufthansa Group has done “better” !

A real challenge for Benjamin Smith the Canadian new CEO of the group. Add to that the legacies competition within the group plus bad unions practices on the French side, something the LH’s group is relatively spared from. Concerning the results I am not sure the latter is doing any better. Luftahansa ‘s released EBIT adjusted figures for Q1 2019 are far from good : LH €mn -102, LX €mn +40, OS €mn -99, EW €mn -257 Total for the group -418. So it seems significantly worse to me. Anyhow both groups have big efforts to make in order to post a profit for this year.

(https://investor-relations.lufthansagroup.com/en/publications/financial-reports.html).

Somethin doesn’t add up …

Net results for Air France (€-256 million), KLM (€-56 million) and Transavia (€-71 million)

Total -383

Why is it stated – 303 in the title ?

Other companies in the group are not included in the figures, like cargo and maintenance, who seem to be healthy

Indeed thank you 🙂